Wisconsin is a better place for everyone when everyone does well. Unfortunately, while the wealthiest have seen their incomes skyrocket in recent decades, incomes have remained the same for the middle class and those who struggle to make ends meet. For Wisconsin families, it’s becoming harder to make it to the middle class and stay there.

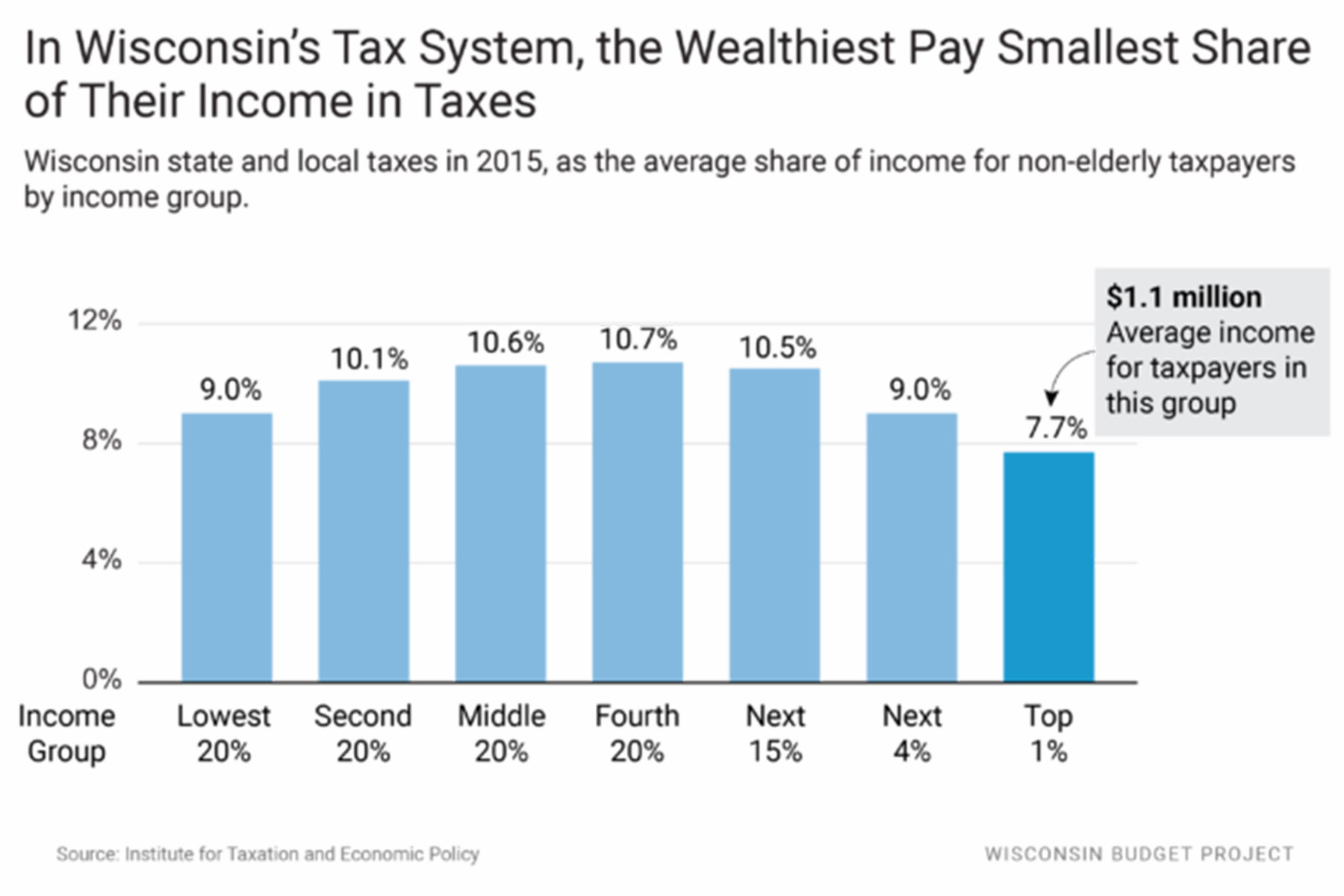

Lawmakers in Wisconsin have only made this problem worse by giving massive breaks to special interests while forcing cuts to things that benefit all of us, like education and clean air and water. As a result, low-income and middle-income families in Wisconsin pay a bigger share of their incomes in state and local taxes on average than the wealthiest households.

The state tax system requires low-and middle-income families to pay between 9 and 11 cents out of every dollar they earn in state and local taxes—yet the wealthiest households pay just 7.7 cents out of every dollar of income on average, the lowest of any income group.

Wisconsin’s middle class, while still one of the largest in the country, is shrinking. Most of the loss occurred as people fell out of the middle class to the lower income tier, rather than climbing into the upper tier. That trend should set off alarm bells for state policymakers, who should be using the tax system and other tools to help people work their way up the economic ladder, not just help those already at the top.

A Wisconsin Budget Project analysis shows that taxpayers in the top 1% could expect an average tax cut of $10,015 in 2017 from recently-approved state tax cuts, compared to just $175 for taxpayers in the lowest 20% of earners. That means that the top 1% got a tax cut 57 times larger than the earners in the lowest income group, and that the top 1% saved more on taxes each week than the lowest income group saved over the course of the entire year.

Wisconsin’s tax system is also tilted in favor of corporations, particularly manufacturers. In 2011, lawmakers created the Manufacturing and Agriculture Credit, which cut manufacturers’ and some other corporations’ taxes by more than $1.4 billion since 2013, nearly eliminating their income tax liability altogether.

This tax cut is highly slanted in favor of the very wealthy, with tax filers with incomes of more than $250,000 receiving 93% of the value of this credit paid through the individual income tax, leaving just 7% for everyone else.

Even though many manufacturers and other corporations already pay little or nothing in income tax, Wisconsin lawmakers are further twisting the tax system by approving public payouts that involve actually sending checks to corporations. For example, Foxconn is set to benefit from up to $4.5 billion in tax breaks and spending from state and local governments, a large portion of which takes the form of refundable tax credits.

Instead of looking for new ways to cut taxes for corporations and people with the highest incomes, state lawmakers should turn their attention to making investments that help Wisconsin communities and families thrive.

Tamarine Cornelius

Originally published on wisconsinbudgetproject.org

Help support the Wisconsin Budget Project with a donation. The organization is engaged in analysis and education on state budget and tax issues, particularly those relating to low-income families. It seeks to broaden the debate on budget and tax policy through public education and by encouraging civic engagement on these issues.