To Greg Lewis, the home was beautiful. Cozy and inviting, it was a two-bedroom house in Milwaukee with a finished basement, two and a half car garage, an attached apartment and a yard. He had his eyes set on it for 42 days, only to learn that the appraisal, or valuation of the property, was lower than he expected. Lewis thought it was going to be about $100,000, as another house on the same block sold for $130,000. Yet the appraisal only came in at $90,000 — meaning banks would be limited in how much they could lend him to buy the home.

He blames the difference on racism. And he is not alone. Experts and some homeowners say historic racism continues to play a role in depressing the value of Black-owned homes, especially in majority-Black neighborhoods.

“Some homes can be beautiful homes and the appraisal comes in short, and then you got to deal with that because they find out that it’s a Black person that owns it and is selling it,” said Lewis, who had to take a pass on buying the house.

Lower appraisals are among many barriers to building wealth faced by Black Americans, which Lewis witnessed first-hand. Wisconsin has one of the lowest Black homeownership rates in the country — a rate that has not improved nationally since 1968. Owning a home allows families to preserve and grow wealth, increases their capacity to borrow and lowers the cost of housing.

In Wisconsin, just 26% of Black residents own their own homes, compared to the white homeownership rate of 72%. Experts say that historic, discriminatory practices such as redlining — areas where banks refused to lend money — and racial covenants, which banned sales to Black buyers, have combined with modern-day racism and overall lower incomes to disadvantage Black Americans, hurting their ability to buy a home.

Lewis has now stalled his house-hunting, discouraged by being outbid so many times.

“It took a lot out of me,” he said. “I went into a depressive state. Looking for a house is really excruciating, and at the end of the day, you want to find something that fits you, something that you like, so that’s the hardest part.”

The National Association of Realtors found in a 2019 study that owning a home remains elusive for many Black buyers, as less than half can afford to buy the typically priced home.

“Black applicants were rejected for mortgage loans at a rate 2.5 times greater than white applicants – 10% vs. 4%, respectively,” the study found. “Nationwide, 43% of Black households can afford to buy the typical home compared to 63% of white households.”

Another study by the Center for Responsible Lending found that communities of color, particularly Black households, face another “significant” barrier to homeownership. It would take 14 years for a Black household at the national median income level to save for a 5% mortgage down payment and closing costs for a median-priced house — and 11 years for a Latino family — while a white median-income family needs nine years to accumulate the same amount of funds.

From homeless to homeowner

Sheila DeCuevas, a mother of four, struggled to find a home for 11 years, unable to save enough money for a deposit or meet financial requirements for a loan.

“There was always problems with qualifications for any type of loan or traditional lending or any type of program, so we had a really tough time trying to get someone to help us,” she said.

DeCuevas rented for years without feeling secure after experiencing homelessness with her then-2-year-old son.

“A lot of families like me go through all this,” she said. “Purchasing a home, it’s their life dream. A lot of people don’t understand because they have stable lives, but acquiring your own place brings peace of mind to a lot of people.”

On top of her financial stress, DeCuevas said she inherited debt from her first marriage, which prevented her from getting a home loan. Feeling overwhelmed, DeCuevas went to seminars on homeownership in hopes of getting help.

She eventually met a real-estate agent who encouraged her to enroll in the Acts Housing program of Milwaukee, which helps low-income families purchase and fix up their own homes. Ana Melo, Acts’ community relations and marketing associate, said the 26-year-old nonprofit provides education and debt elimination programs and other services for prospective homeowners.

“It’s not only about acquiring property, it’s about acquiring good habits,” DeCuevas said, adding that Acts Housing helped her become more financially literate.

Thanks to Acts Housing, DeCuevas now owns her own home. And her children are proud of what their family has accomplished.

“Going from homeless to owning our own place, and them telling us that they’re proud of us, and that they’re thankful for us … they’re more smart, they understand that owning is a big thing,” said DeCuevas, who now works for Acts Housing as an office coordinator. “My oldest is already talking about ‘When I’m buying my own house,’ so they’re not thinking about renting. They’re not thinking about making other people wealthy, they want to make themselves stable and more wealthy.”

Homeownership’s spinoff effects

Homeownership is a key metric for standard of living in several ways. Homes are often the largest single asset a family owns, providing a source of wealth for current and future generations. Homeownership also provides housing stability, which can help children do better in school and provide other positive benefits. It is a benefit that too many Black people do not enjoy.

Kurt Paulsen, a University of Wisconsin-Madison expert on housing affordability, said little headway has been made in increasing Black homeownership.

“Nationwide, the Black homeownership rate is still not where it needs to be, and in some ways, has not significantly improved since the 1968 Fair Housing Act,” Paulsen said.

The national Black homeownership rate is 44% compared to the white homeownership rate of 74.5%. The racial disparities in Wisconsin housing reflect not only historic and economic inequalities, but discrimination in all levels of the housing process, according to Paulsen.

Black households often face higher loan denial rates and higher interest rates. Although housing discrimination based on race is illegal through the Fair Housing Act, Paulsen said mortgage lenders sometimes deny Black households loans or charge higher interest rates due to lower income and a higher debt-to-income ratio.

Kacie Lucchini Butcher is a public history project director at UW-Madison whose research primarily focuses on housing inequity. Butcher emphasized the alarming implications of low Black homeownership rates, including the ability of such families to build intergenerational wealth.

Nationally, the average white household has a net worth of $171,000 — 10 times higher than the average Black household’s net worth of $17,150.

“If homeownership continues in the way that it does, and if access to housing continues in the way it does, we are just going to see a continued exacerbation of wealth inequality and of poverty. One of the best ways to fix this is to get everybody housing,” Butcher said.

Affordability a major problem

Building intergenerational wealth is not the only challenge Black Americans face. UW-Madison professor Kris Olds, an expert on urban planning and gentrification, said housing affordability remains a huge problem, especially in Madison, but also elsewhere in Wisconsin.

“One of the problems in Madison is so much of it (housing) is allocated to single family zoning districts, and it’s quite expensive to access that,” he said.

If potential homeowners are unable to demonstrate that they have a high enough income relative to the cost of the home and the down payment, Olds said, “you’re basically locked out of the homeownership market, even if it’s relatively affordable.”

In Milwaukee, income levels for Black Americans have declined by 30% since 1979. Marc Levine, UW-Milwaukee professor emeritus of history, economic development and urban studies found that across a series of metrics, Black Americans in Milwaukee are worse off today than they were 40 to 50 years ago.

Said Olds: “If you’ve only been renting all your life, if you’ve got a low credit rating, but nothing saved up, even if you’ve got a new job, and a relatively good stable income, you still have difficulties getting into that particular housing market.”

Historical barriers to homeownership

Paige Glotzer, assistant professor of history at UW-Madison and author of a book on the history of housing discrimination, said there are a number of large, structural barriers to opportunity for many Black Americans, regardless of their socioeconomic status, ultimately contributing to “a power imbalance” between Black and white Americans.

Modern-day housing market discrimination permeates society in inconspicuous ways, Glotzer said. The value placed on a house, which she said is often based on race, also affects property taxes, funding for schools, commuting times and ultimately Black American purchasing power.

“It’s sometimes hard to detect because you can always give a colorblind reason why you’re taking away value from a house,” she explained.

Glotzer added that a house owned by Black people or situated in a Black neighborhood will appreciate less in value than the exact same house in a majority white neighborhood.

“This means that there are a few things related to housing that are still very discriminatory, even though it has become illegal,” she said.

Levine also noted that a Black household in Milwaukee with an income over $100,000 is twice as likely to live in a concentrated poverty neighborhood as a white household with income under $10,000 a year — meaning even a high income does not insulate Black Wisconsinites from race-based housing discrimination.

Redlining explained

Generations after the 1968 Fair Housing Act was enacted, white and Black homeownership rates and conditions remain miles apart. This is especially true in Milwaukee, one of the most segregated major cities in the United States.

“African Americans are more likely to buy lower-priced homes in segregated neighborhoods because of historical segregation patterns,” Paulson said.

A main reason for housing segregation is redlining, which began with the Home Owners’ Loan Corporation of 1932 — when the Great Depression thrust America into a housing crisis.

The federal government issued bonds to refinance the majority of Americans’ mortgages. The government developed standards for which mortgages and neighborhoods it would refinance by color coding geographical areas by risk factor. Green indicated the lowest risk factors and red signaled the highest perceived risk factors — thus the term redlining.

“Redlining meant that a neighborhood that had the presence of inharmonious racial groups would be color coded red,” Paulson said. “That was both Black neighborhoods and white neighborhoods that had a significant presence of people of color.”

Prior to the 1930s, American cities were not officially segregated by race, but because the Federal Housing Administration provided insurance for mortgages, the federal government believed that neighborhood risk factors would affect property values. The FHA flagged a neighborhood’s racial composition as a primary risk factor.

Redlining was “a close collaboration” between white federal policymakers, planners and developers, Glotzer said.

“Redlining was actually a form of lending discrimination,” she said. “There are huge hurdles in terms of getting access to credit, to capital, to money and to good banking that is still very much a huge determinant of how people can live. And that is, and continues to be, very much something really based on racism.”

Efforts abound to build homeownership

Several public agencies and nonprofits are working to help Black residents of Wisconsin become homeowners. Real-estate agent Mo Simmons, who is helping Lewis buy a home, belongs to Take Root Milwaukee, a consortium of 50 community organizations, neighborhood groups, HUD-certified housing counseling agencies, real estate agents and lenders that helps residents buy, keep or fix a home.

“There’s been a lot of biases that have kept Black people from being able to obtain homeownership,” she said. “But there’s now, in 2021, a lot more education and a lot more resources … and Take Root is providing that,” she said.

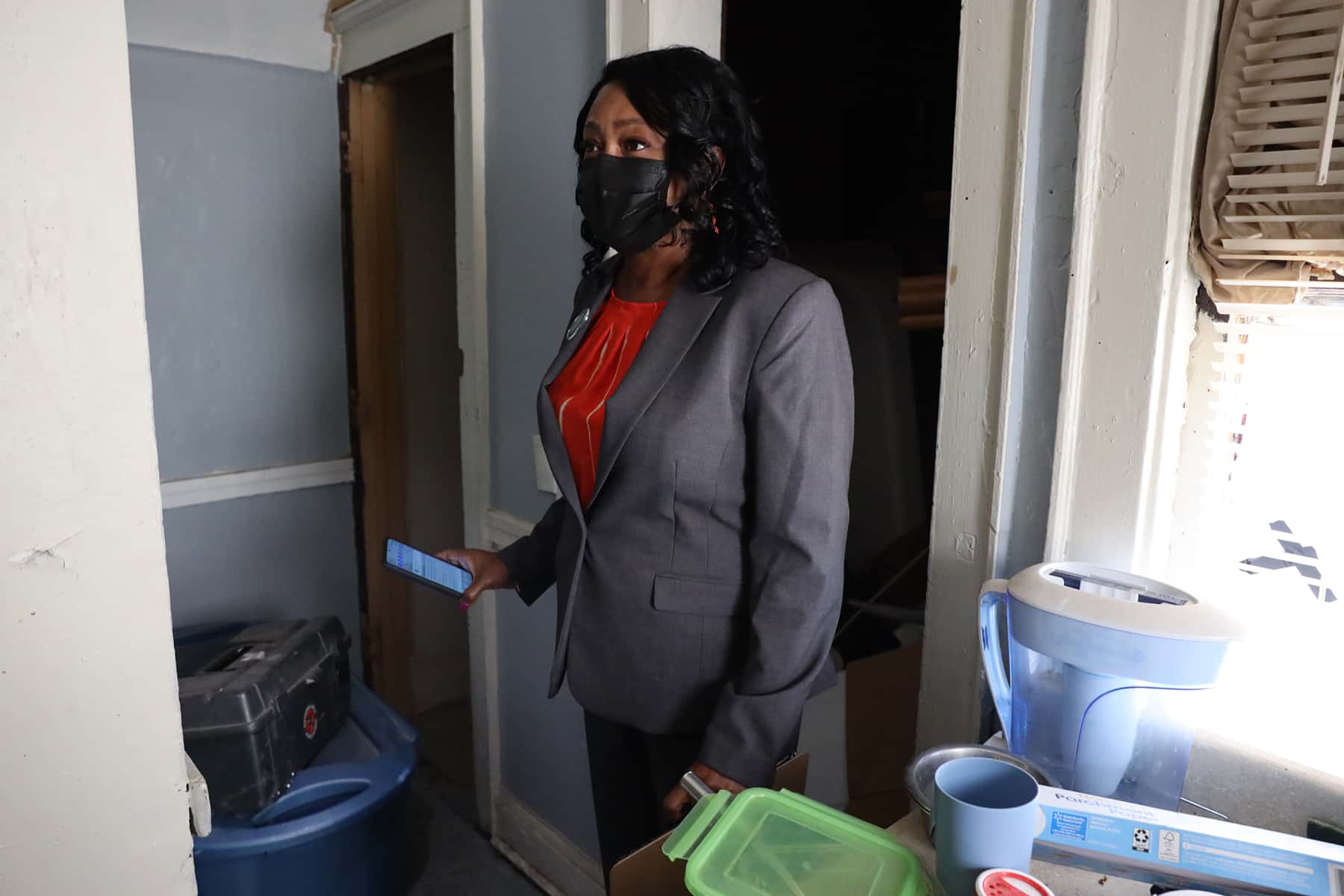

State Rep. Shelia Stubbs, D-Madison, co-chair of the Speaker’s Task Force on Racial Disparities, said other processes must change to bolster Black homeownership rates.

“Why do you need to have credit scores when you have enough rental history that you’ve probably rented from some landlord for 20, 30 years?” Stubbs asked. “So you are good enough to rent, but you’re not good enough to own? I have found that to be an inequity.”

A recent Wisconsin Policy Forum analysis found that between 2014 and 2018, the city of Milwaukee spent $26.4 million to help existing homeowners fix up their properties but comparatively less — $3.5 million — on increasing homeownership. The city also spent $19 million on expanding the amount of affordable housing. The think tank suggested that Milwaukee could better focus its efforts to boost the level of homeownership and affordable housing in the city.

“With more than 20 housing programs divided across three city agencies and no housing director, the city’s housing portfolio might benefit from stronger organization and clearer leadership,” the policy forum found. “Each city housing program has somewhat distinct policy objectives and target populations, but there is also considerable overlap between many, including some that are managed by different departments.”

‘Everyone should own a home’

One resource is the Wisconsin Housing and Economic Development Association (WHEDA), created in 1972 by the Wisconsin Legislature, which holds over $2 billion in assets and serves as a lender for state residents in need of affordable housing financing. The organization issued 2,680 loans — totaling $366 million — to first-time homebuyers and working families in the 2020 fiscal year.

Joaquin Altoro, CEO of WHEDA, said the history of racial oppression can affect potential homebuyers’ perception about their qualifications, fearing that banks will not lend to them or real estate agents will not want to work with them. Another issue contributing to the homeownership gap is what he describes as a “significant” poverty rate for communities of color in Wisconsin.

“And if you don’t have dollars, how in the world are you going to buy a house if you can’t even support your family?” Altoro asked.

Still, Altoro said increasingly, financial institutions are identifying potential owners of color and helping them buy homes.

“What we’re seeing is there are banks, and there are research firms that are getting deep in the data, and uncovering in communities of color who is mortgage-ready, like, ‘Who is that person? Where do they live? What do they want to buy?’ Because if we can uncover that information, and share it with the world and say, ‘These are the people,’ then there might be a way for us to go directly at them,” he said.

Altoro wants to change the false perception that there are few Black and Latinos qualified to purchase a home by helping more renters of color to become owners.

“I’m not trying to change racism, I can’t do that by myself,” he said. “But I can change the fact that we put one, two, three homeowners in a neighborhood.”

Stubbs echoed Altoro’s hope for change.

“We’re investing more money into (homeless) shelters than housing, and I think that’s a problem.”

Simmons, of EXIT Realty Horizons, is doing her part, helping Lewis find his dream home. From the beginning, she advised Lewis to get his credit fixed.

“The people that Mo actually put me in front of just broke it down for me, as well as her, letting me know in regards to my income what I can actually afford and how high I should go in regards to looking for a home,” he said.

For Lewis, he looks forward to the day he can finally buy a house — and possibly pass that asset along to his family. He said he is grateful for Simmons’ help that he even invited her to his wedding.

“I think everyone should own a home,” he said. “That’s a start to building some generational wealth for Blacks.”

Gaby Vinick and Alexa Chatham

Coburn Dukehart

The nonprofit Wisconsin Center for Investigative Journalism collaborates with Wisconsin Public Radio, Wisconsin Public Television, other news media and the UW-Madison School of Journalism and Mass Communication. All works created, published, posted or disseminated by the Center do not necessarily reflect the views or opinions of UW-Madison or any of its affiliates.