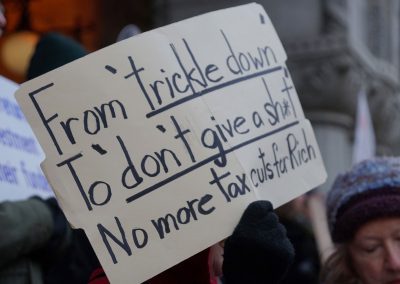

Dozens in Milwaukee gathered outside the office of U.S. Senator Ron Johnson on December 18, to draw attention to the problems of Trump’s corporate tax bailout that studies show will further increase inequality in America.

The group of protestors who marched through the streets of Milwaukee, chanting about taxing the rich, comes after a long year of similar rallies that have pushed back against Republican policies. With the new tax plan positioned for congressional passage, the crowd gathered to express their frustration over policies that favor the extremely wealthy in America at the expense of everyone else.

“I shouldn’t have to be here to protest something this absurd,” said a protestor who identified herself as Lois. “It’s a tax bill for the rich and it’s putting a burden on our children’s future. I’m just hoping that my voice will be heard.”

Senator Johnson originally withheld his vote in the Senate on the GOP’s tax giveaway plan until he was able to include a “Badger Bribe” provision, further reducing taxes on “pass through” entities like Pacur, the company he co-founded and in which he maintains a personal financial interest.

“This tax bill will take away all the health care that keeps me alive,” said Gail Campbell of Saint Francis. “I’m a 69 year old senior citizen, a cancer patient, and I have Parkinson’s. I need Medicare and Medicaid intact, and the tax plan will go after them later to resolve the deficit it will create.”

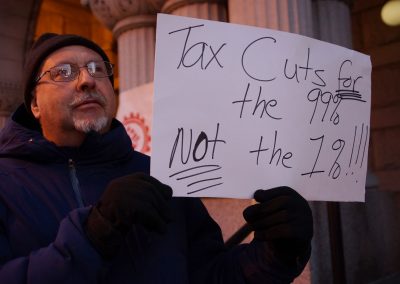

A recent report from the Tax Policy Center found that while Americans from all income levels will see an average reduction in taxes in 2018 and 2025, most benefits will go to wealthy Americans.

A member of the organization Not One Penny, Erica Flynn, announced to the group her candidacy to run for State Representative from Assembly District 84.

“It’s kind of incredible to me that a year ago, like many others, I went through the election and was really depressed by the outcome,” said Flynn. “I couldn’t imagine running for office, but then slowly I started to realize that a lot of my fellow citizens were fighting against the Trump agenda. They gave me strength, and I felt that I had to stand up just like them.”

By 2027, it is projected that 83% of the benefits of the Republican tax cut will flow to the top 1%, while over half of all Americans, or 100 million working families, will pay more. For people struggling to make ends meet, the plan is considered to be detrimental.

“The GOP voted to cut taxes for millionaires, billionaires, and wealthy corporations, inevitably forcing cuts to programs working families depend on like Medicaid, Medicare, public education, and Social Security. While passing the largest middle-class tax hike in a generation, the GOP said ‘no thanks’ to helping working families,” said Tim Hogan of Not One Penny. “The tax proposal is wildly unpopular with a majority of Americans, and voters won’t forget those who enabled this hypocrisy.”

Under the Republican tax plan, households earning less than $25,000 would see an average tax cut of $60 in 2018, and middle-class households would see an average cut of $900. Roughly two-thirds of the benefits will go to the top 20 percent of earners.

In 2018, the top 1% of households would see an average tax cut of $51,000, a number that will continue to grow over time.

After 2025, the year when the individual tax provisions are set to expire, the average tax cuts for all goes away.

In 2027, households earning less than $28,000 would see an average tax increase of $30, while the top 1% of households would receive a $20,660 cut. On average, the top 0.1 percent would get a benefit of $148,260. About 70% of households in the middle quintile of earners would see tax hikes, as opposed to 23% of those in the top 1%.

© Photo

Lee Matz