Entering court using a walker, a doctor’s note clutched in his hand, 70-year-old Dana Williams, who suffers serious heart problems, hypertension and asthma, pleaded to delay eviction from his two-bedroom apartment in Atlanta.

Although sympathetic, the judge said state law required him to evict Williams and his 25-year-old daughter De’mai Williams in April because they owed $8,348 in unpaid rent and fees on their $940-a-month apartment.

They have been living in limbo ever since.

They moved into a dilapidated Atlanta hotel room with water dripping through the bathroom ceiling, broken furniture and no refrigerator or microwave. But at $275-a-week, it was all they could afford on Williams’ $900 monthly social security check and the $800 his daughter gets biweekly from a state agency as her father’s caretaker.

“I really don’t want to be here by the time his birthday comes” in August, De’mai Williams said. “For his health, it’s just not right.”

The Williams family is among millions of tenants from New York state to Las Vegas who have been evicted or face imminent eviction.

After a lull during the pandemic, eviction filings by landlords have come roaring back, driven by rising rents and a long-running shortage of affordable housing. Most low-income tenants can no longer count on pandemic resources that had kept them housed, and many are finding it hard to recover because they haven’t found steady work or their wages haven’t kept pace with the rising cost of rent, food and other necessities.

Homelessness, as a result, is rising.

“Protections have ended, the federal moratorium is obviously over, and emergency rental assistance money has dried up in most places,” said Daniel Grubbs-Donovan, a research specialist at Princeton University’s Eviction Lab.

“Across the country, low-income renters are in an even worse situation than before the pandemic due to things like massive increases in rent during the pandemic, inflation and other pandemic-era related financial difficulties.”

Eviction filings are more than 50% higher than the pre-pandemic average in some cities, according to the Eviction Lab, which tracks filings in nearly three dozen cities and 10 states. Landlords file around 3.6 million eviction cases every year.

Among the hardest-hit are Houston, where rates were 56% higher in April and 50% higher in May. In Minneapolis/St. Paul, rates rose 106% in March, 55% in April and 63% in May. Nashville was 35% higher and Phoenix 33% higher in May; Rhode Island was up 32% in May.

The latest data mirrors trends that started last year, with the Eviction Lab finding nearly 970,000 evictions filed in locations it tracks — a 78.6% increase compared to 2021, when much of the country was following an eviction moratorium. By December, eviction filings were nearly back to pre-pandemic levels.

At the same time, rent prices nationwide are up about 5% from a year ago and 30.5% above 2019, according to the real estate company Zillow. There are few places for displaced tenants to go, with the National Low Income Housing Coalition estimating a 7.3 million shortfall of affordable units nationwide.

Many vulnerable tenants would have been evicted long ago if not for a safety net created during the pandemic.

The federal government, as well as many states and localities, issued moratoriums during the pandemic that put evictions on hold; most have now ended. There was also $46.5 billion in federal Emergency Rental Assistance that helped tenants pay rent and funded other tenant protections. Much of that has been spent or allocated, and calls for additional resources have failed to gain traction in Congress.

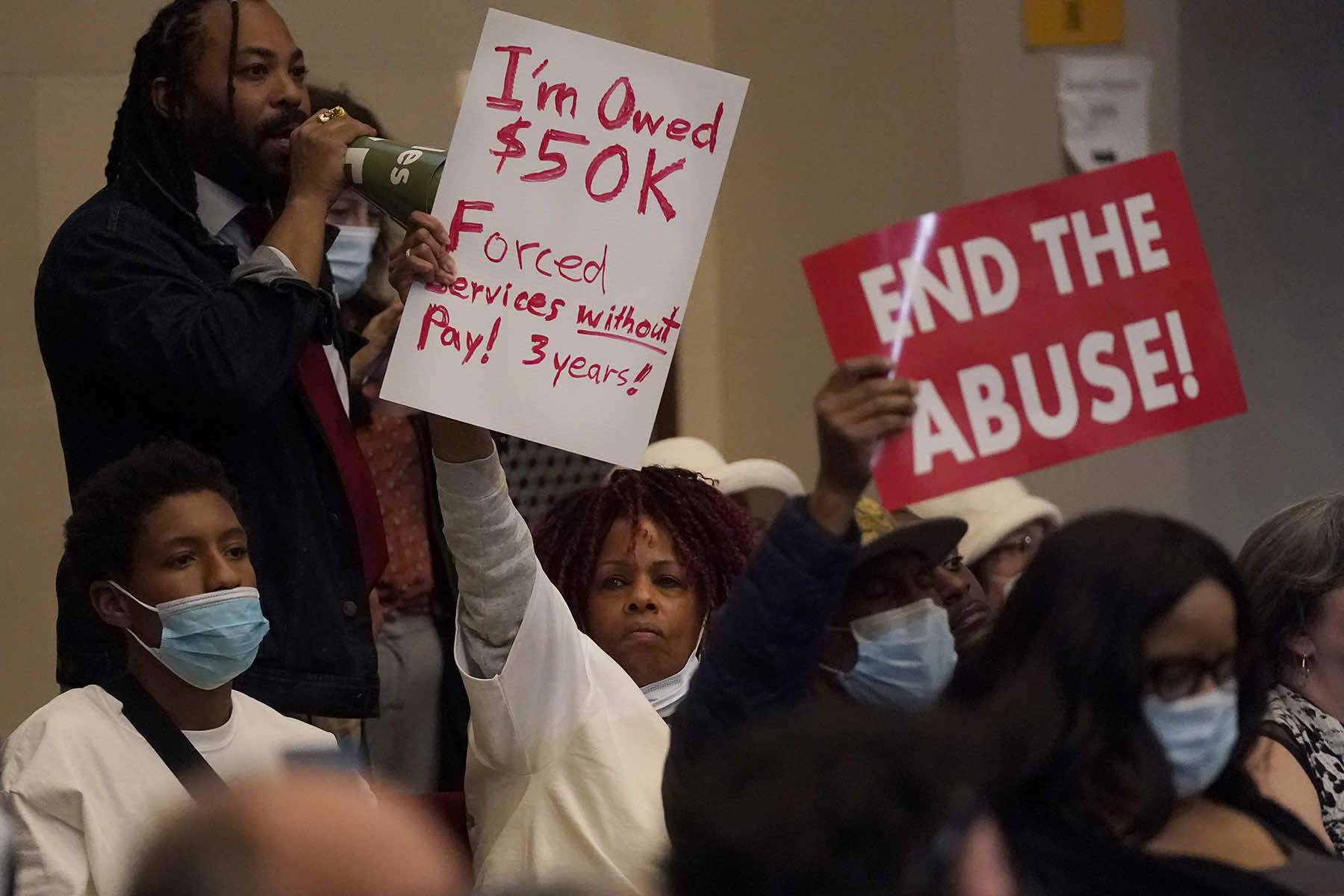

“The disturbing rise of evictions to pre-pandemic levels is an alarming reminder of the need for us to act — at every level of government — to keep folks safely housed,” said Democratic U.S. Rep. Ayanna Pressley of Massachusetts, urging Congress to pass a bill cracking down on illegal evictions, fund legal help for tenants and keep evictions off credit reports.

Housing courts are again filling up and ensnaring the likes of 79-year-old Maria Jackson.

Jackson worked for nearly two decades building a loyal clientele as a massage therapist in Las Vegas, which has seen one of the country’s biggest jumps in eviction filings. That evaporated during the pandemic-triggered shutdown in March 2020. Her business fell apart; she sold her car and applied for food stamps.

She got behind on the $1,083 monthly rent on her one-bedroom apartment, and owing $12,489 in back rent was evicted in March. She moved in with a former client about an hour northeast of Las Vegas.

“Who could imagine this happening to someone who has worked all their life?” Jackson asked.

Last month she found a room in Las Vegas for $400 a month, paid for with her $1,241 monthly social security check. It’s not home, but “I’m one of the lucky ones,” she said.

“I could be in a tent or at a shelter right now.”

In upstate New York, evictions are rising after a moratorium lifted last year. Forty of the state’s 62 counties had higher eviction filings in 2022 than before the pandemic, including two where eviction filings more than doubled compared to 2019.

“How do we care for the folks who are evicted … when the capacity is not in place and ready to roll out in places that haven’t experienced a lot of eviction recently?” said Russell Weaver, whose Cornell University lab tracks evictions statewide.

Housing advocates had hoped the Democrat-controlled state Legislature would pass a bill requiring landlords to provide justification for evicting tenants and limit rent increases to 3% or 1.5 times inflation. But it was excluded from the state budget and lawmakers failed to pass it before the legislative session ended this month.

“Our state Legislature should have fought harder,” said Oscar Brewer, a tenant organizer facing eviction from the apartment he shares with his 6-year-old daughter in Rochester.

In Texas, evictions were kept down during the pandemic by federal assistance and the moratoriums. But as protections went away, housing prices skyrocketed in Austin, Dallas and elsewhere, leading to a record 270,000 eviction filings statewide in 2022.

Advocates were hoping the state Legislature might provide relief, directing some of the $32 billion budget surplus into rental assistance. But that hasn’t happened.

“It’s a huge mistake to miss our shot here,” said Ben Martin, a research director at nonprofit Texas Housers. “If we don’t address it, now, the crisis is going to get worse.”

Still, some pandemic protections are being made permanent, and having an impact on eviction rates. Nationwide, 200 measures have passed since January 2021, including legal representation for tenants, sealing eviction records and mediation to resolve cases before they reach court, said the National Low Income Housing Coalition.

These measures are credited with keeping eviction filings down in several cities, including New York City and Philadelphia — 41% below pre-pandemic levels in May for the former and 33% for the latter.

A right-to-counsel program and the fact that housing courts aren’t prosecuting cases involving rent arears are among the factors keeping New York City filings down.

In Philadelphia, 70% of the more than 5,000 tenants and landlords who took part in the eviction diversion program resolved their cases. The city also set aside $30 million in assistance for those with less than $3,000 in arears, and started a right-to-counsel program, doubling representation rates for tenants.

The future is not so bright for Williams and his daughter, who remain stuck in their dimly-lit hotel room. Without even a microwave or nearby grocery stores, they rely on pizza deliveries and snacks from the hotel vending machine.

Williams used to love having his six grandchildren over for dinner at his old apartment, but those days are over for now.

“I just want to be able to host my grandchildren,” he said, pausing to cough heavily. “I just want to live somewhere where they can come and sit down and hang out with me.”