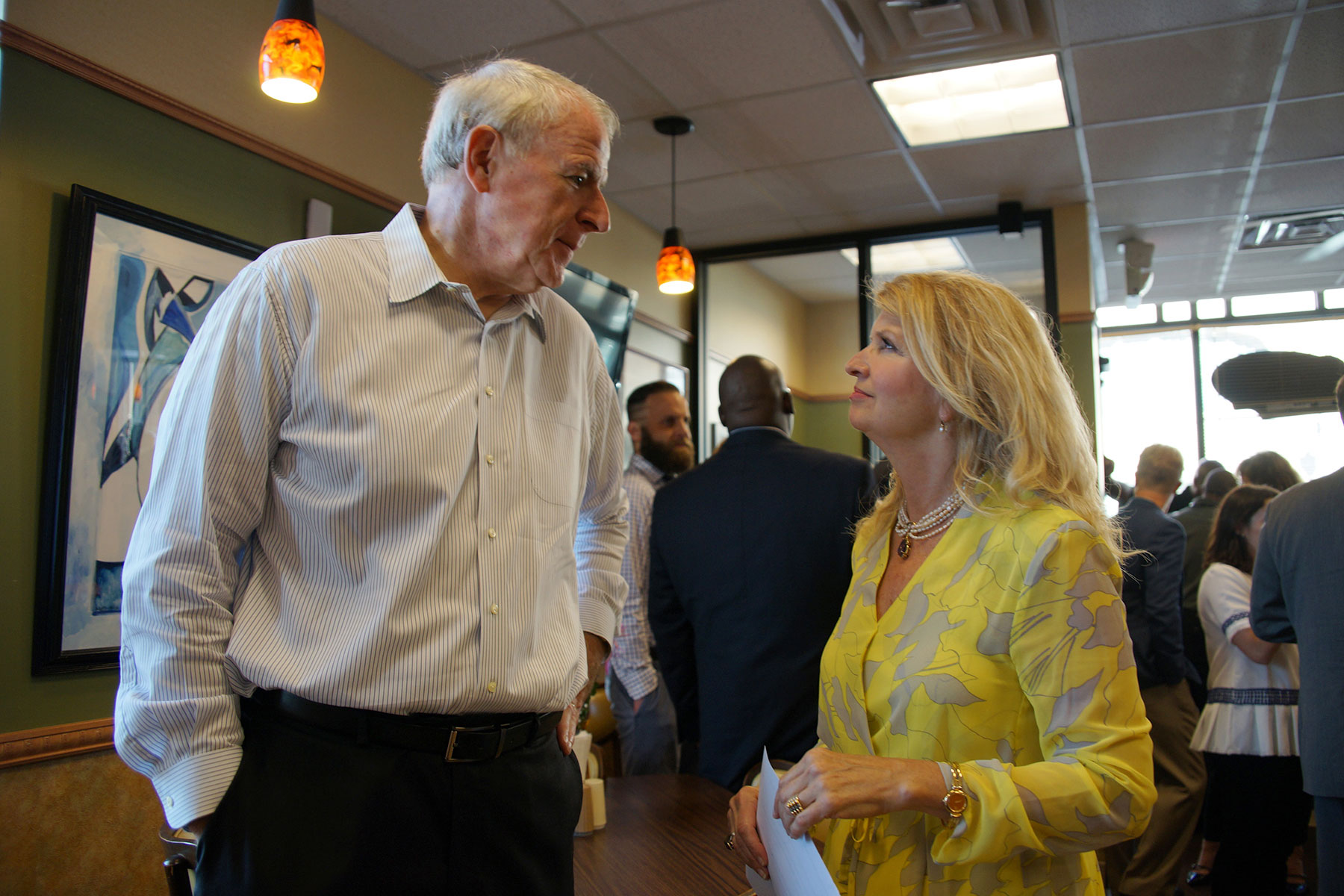

Milwaukee Mayor Tom Barrett, WWBIC President Wendy Baumann, Wells Fargo, Greater Milwaukee Foundation, and Marquette University to spoke about the Diverse Community Capital Award and its impact on the local area.

Serving in her 23rd year as president of the Wisconsin Women’s Business Initiative Corporation, Wendy Baumann announced on July 8 at Daddy’s Soul Food & Grille that WWBIC had the honor of being a part of the first round of Wells Fargo’s Diverse Community Capital (DCC) program.

“That award is two-fold, a $400,000 grant over 2 years and $600,000 in new equity equivalent investment,” explained Baumann. “The funding is significant for us locally as we continue to make investments in the lives of people, in our neighborhood communities of Milwaukee, for entrepreneurs and business owners, and to help the health and well being of our city.“

Wells Fargo announced a year ago that it would deliver $75 million in grants and lending capital over three years to Community Development Financial Institutions that serve diverse-owned small businesses. CDFIs are mission-based lenders that focus specifically on micro and small business loans to diverse communities like minorities and low income individuals.

WWBIC’s proposal competed against 150 CDFIs nationwide for the grant, and were part of the 15 financial institutions awarded in the first round of funding.

“This is a tremendous opportunity for us to make a significant investment in the community,” said Sang Kim, Region President of Wells Fargo. “It helps our small businesses grow, which helps our neighborhoods flourish, and brings the community together.”

The gathering started with a moment of reflection for the events in Dallas, which had occurred the previous night, and all the tragic events of that week. WWBIC’s announcement was greeted as a much needed piece of the solution to resolve disparity and racial inequity in Milwauke.

Daddy’s Soul Food & Grille hosted the event, as a WWBIC client and example of the organization’s investment in the heart of Milwaukee. Owners Angela and Bennie Smith said the motto for their restaurant is eat like you are at home.

“When you have a dream and put everything out on the table, getting that ‘no’ can be a huge disappointment,” said Smith as he described the conversation with his wife about quitting his job to start the restaurant. “But then we got that first ‘yes’ from WWBIC, and they stood right by us. So we were determined to work hard so they won’t regret it.”

In addition to lending capital and grant support, Wells Fargo is providing social capital programs to CDFIs to help increase their capacity to lend to diverse small businesses that includes mentorship training, knowledge sharing networks, consulting, and other collaborative efforts.

“A lot of attention is being paid to all the good things going on downtown,” said Tom Barrett, Mayor of the City of Milwaukee. “But I refer to this area as the heart of Milwaukee. You have to have a strong heart to function. And by having the investments like we are seeing here, we are strengthening the entire city.”

Bennie Smith’s story about quitting his job reminded the Mayor of his own family experience. His father was 47 years old and had worked at a job for 19 years when he did the same thing. He told his mother that he was quitting his job to start a business.

“There is an energy here that is very important to the city and we need to support it,” Mayor Barrett added. “It’s all about creating opportunities right here in our backyard.”

WWBIC’s strategic plan is to improve the economic well being of the individuals they work with. Their programs offer quality business education, one-on-one support of entrepreneurs and business owners, and access to fair and responsible capital. The Wells Fargo Diverse Community Capital Grant is the latest show of support for the financial institution’s work.

In addition to the grant, the Greater Milwaukee Foundation also came in and put $150,000 on the table for WWBIC to do more of what they already do, and go deeper to specifically for transform the Northwest side of Milwaukee.

“We know that strong commercial corridors are the heart of neighborhoods,” said Darlene Russell, Senior Program Officer of the Greater Milwaukee Foundation. “Communities are strong when the economies are fair, and inclusive, and work for everyone. To reach those goals, we need to remove the obstacles and improve access to resources that allow diverse small businesses and entrepreneurship to thrive.”

About WWBIC

The Wisconsin Women’s Business Initiative Corporation (WWBIC) has provided Wisconsin quality business and financial education coupled with access to fair capital and financial products for nearly 30 years. WWBIC’s impact is seen through the thousands of entrepreneurs, business owners and individuals whom they assist annually. WWBIC’s work and support put business dreams to work. Every day WWBIC is inspired to improve the economic well-being of fellow residents through business loans, classes, coaching and money management tools. While they care about everyone, WWBIC’s efforts are focused and dedicated to women, minority and lower-income individuals.

Since WWBIC was incorporated as a 501(c)3 in 1987, it has: Loaned over $46 million to nearly 4,000 business borrowers, helped entrepreneurs create and retain 8,939 jobs, assisted 55,317 clients and coached 152 individuals and families in purchasing their own homes through their IDA program.

About Wells Fargo

Wells Fargo & Company (NYSE: WFC) is a diversified, community-based financial services company with $1.8 trillion in assets. Founded in 1852 and headquartered in San Francisco, Wells Fargo provides banking, insurance, investments, mortgage, and consumer and commercial finance through 8,800 locations, 13,000 ATMs, the internet (wellsfargo.com) and mobile banking, and has offices in 36 countries to support customers who conduct business in the global economy. With approximately 269,000 team members, Wells Fargo serves one in three households in the United States. Wells Fargo & Company was ranked No. 30 on Fortune’s 2015 rankings of America’s largest corporations. Wells Fargo’s vision is to satisfy our customers’ financial needs and help them succeed financially. Wells Fargo perspectives are also available at Wells Fargo Blogs and Wells Fargo Stories.