Everyone in Wisconsin deserves the opportunity to fully participate in and benefit from the state’s economic growth. Our economy, our communities, our schools, and our families will fare better when every person in the state has full access to opportunity.

But the gains from Wisconsin’s growth are not being widely shared. A growing concentration of income is being held in the hands of the top 1%, while the incomes of everyone else stagnate, making it harder to make ends meet and achieve economic security. There is an even greater gap between the almost exclusively white 1% in Wisconsin and communities of color where incomes are appallingly lower than their white counterparts.

The incomes of the very richest have skyrocketed in recent decades. Since 1973, the incomes of the top 1% nearly tripled even after taking inflation into account, to the point where the average income of the top 1% of Wisconsin residents is now $964,000. Meanwhile, the average incomes of everyone else increased a paltry 18% over that same period.

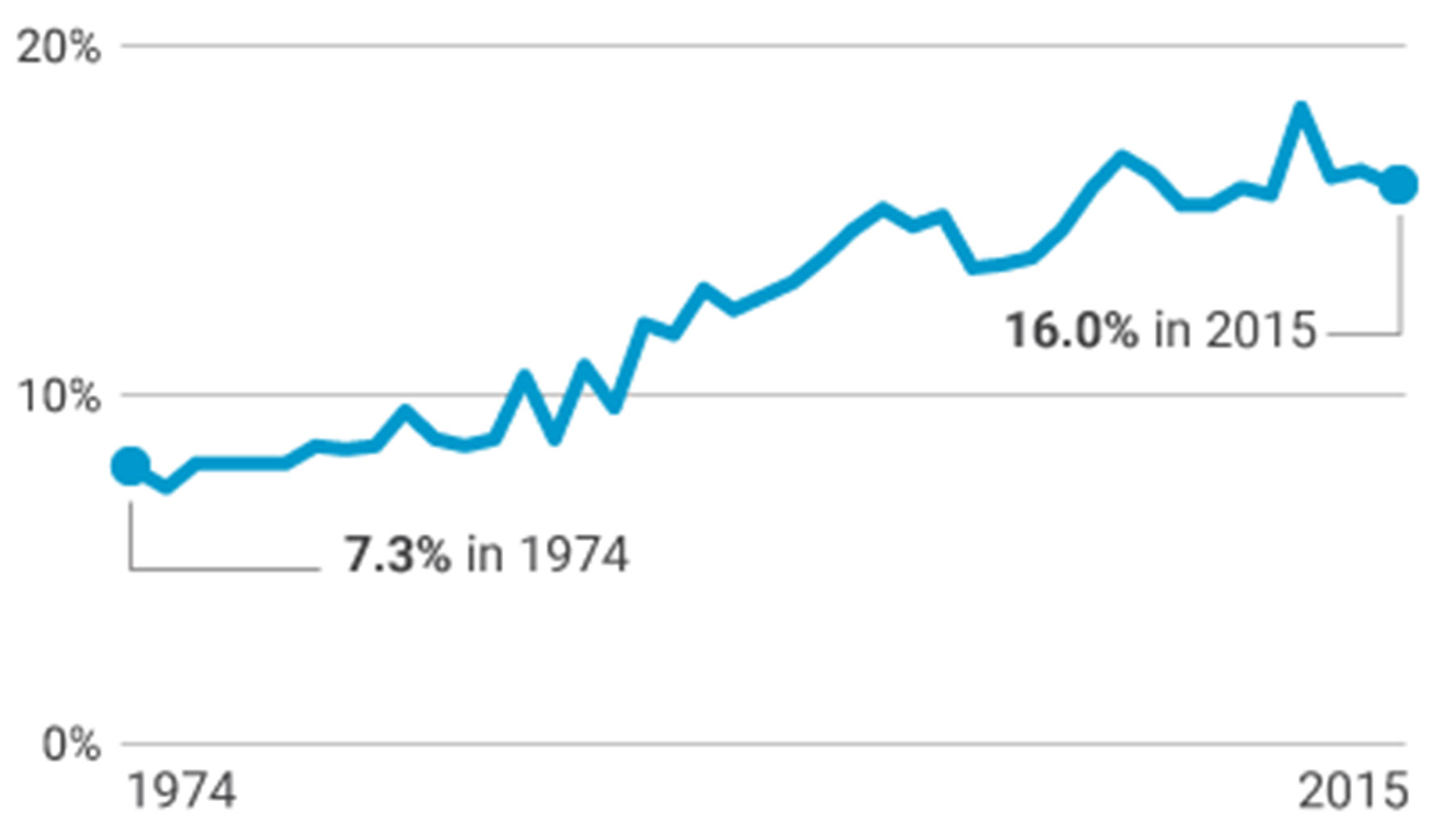

It’s not just that the rich are getting richer. They are taking a continually-growing share of all income, leaving a smaller piece of the pie for everyone else. The share of income going into the pockets of the top 1% has more than doubled since the 1970s, to the point where the top 1% is now taking 16% of all income in Wisconsin, or $1 out of every $6 earned.

This trend is exacerbated by lawmakers who pass policies that increase the amount of economic activity in the state without asking who benefits from those policies. Simply increasing the overall level of economic activity will do little to increase the pay of workers with low wages, and instead will funnel more money to the wealthy and well-connected, who already receive an outsized share of total resources.

One example of policies that direct even larger amounts of income into the pockets of the very wealthy is the recent handout to the Kimberly-Clark manufacturing plant in the Fox Valley. After Kimberly-Clark announced plans to close the profitable plant, Governor Walker gave Kimberly-Clark a five-year subsidy worth up to $28 million. That subsidy won’t do much to boost the incomes of workers, from whom Kimberly-Clark demanded salary concessions averaging $8,000 per worker as a condition of keeping the factory open. Instead, the subsidy represents the use of public resources to primarily benefit the wealthy Kimberly-Clark shareholders. This subsidy comes on top of a state tax credit that wipes out the income tax liability of Kimberly-Clark and other manufacturers, another policy that confers huge benefits on a very small number of people and businesses.

The widening income gap, and the policies that contribute to the gap, disproportionately impact, block opportunity, and further restrict economic advancement for people of color in Wisconsin. A legacy of racial discrimination and public disinvestment in communities of color mean that people of color are often barred from joining the group of highest earners, and are left with a continually shrinking piece of the pie.

There’s no magic bullet that will completely undo the growth in inequality in Wisconsin, any more than there was a single cause. Many of the underlying trends causing the changes in our economic landscape are national and are related to broader changes in education, technology, and trade. Nevertheless, there are a number of steps we can take at the state level to keep income inequality from growing, including raising the minimum wage, strengthening tax credits for working families, combatting wage theft, and requiring paid family and sick leave. We also need to create a tax system that provides a level playing field for Wisconsin families and businesses, instead of one that further advantages the wealthy and well-connected who rig the tax code for their own benefit.

Wisconsin families and businesses can’t thrive when all the income growth goes to the very top. For Wisconsin’s economy to be on a solid foundation, everyone needs to benefit from increases in productivity. We must take action at the state level to counteract the growing concentration of income in a few, mostly white, hands and expand opportunity for everyone.

Share of income going to Top 1% in Wisconsin climbs

The Top 1% claimed 16% of all income in Wisconsin in 2015, more than double the share claimed in 1974. The growing concentration of income in the hands of the Top 1% leaves fewer resources for everyone else.

Tamarine Cornelius

Lee Matz

Originally published on wisconsinbudgetproject.org

Help support the Wisconsin Budget Project with a donation. The organization is engaged in analysis and education on state budget and tax issues, particularly those relating to low-income families. It seeks to broaden the debate on budget and tax policy through public education and by encouraging civic engagement on these issues.