The Wisconsin Women’s Business Initiative Corporation (WWBIC) showcased their clients and community investments at the organizations’s annual luncheon, held at the Potawatomi Hotel & Casino on December 2.

The venue placed a spotlight on small business owners, who lined the convention area outside the ballroom. The event’s theme this year acknowledged food and beverage businesses. In 2015, WWBIC assisted 226 Wisconsin companies in the industry, and many were there to display and promote their products.

“Main street is a key engine of the American economy, and small businesses create jobs and wealth, and are also sources of social and cultural capital,” said Wendy Baumann, president of WWBIC. “We can be persistent for positive change, and channel that energy into prosperity where one puts their money into meaning and meaningful work.”

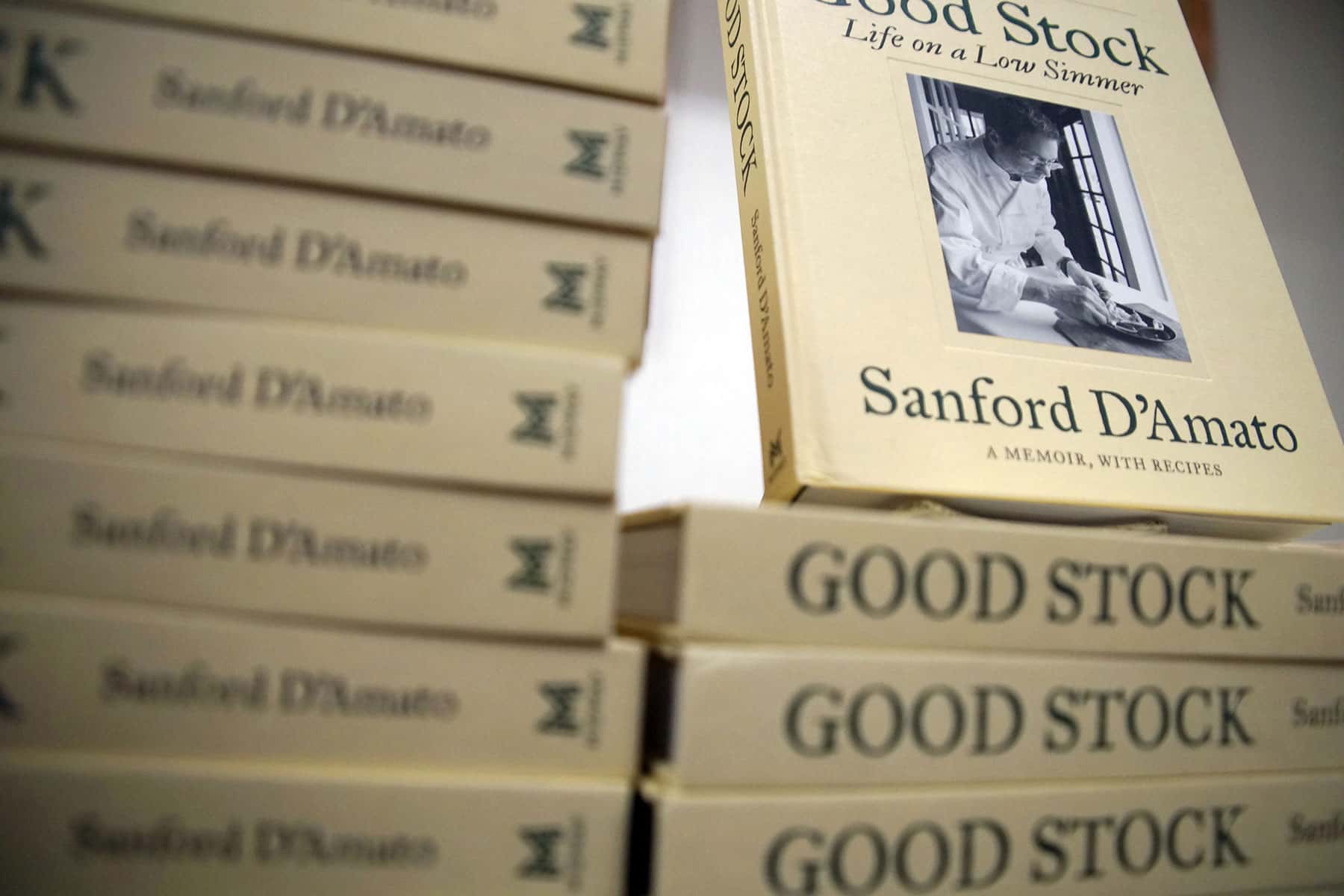

More than one thousand guests attended the luncheon, which included chef Sanford D’Amato as the featured speaker. D’Amato sold his namesake business after 23 years in 2012. The Sanford Restaurant was an example of how a neighborhood business could serve the community while it gained national status. As a James Beard Award winner for Best Chef in the Midwest, D’Amato talked about his life lessons and business struggles, cooking for the Dalai Lama in 2007, and career highlights covered in his memoir, “Good Stock: Life on a Low Simmer.”

WWBIC also honored Girolama Megna, who recently retired her ownership of a Brady Street institution Mimma’s Cafe, with a city proclamation from Mayor Tom Barrett. Megna joined the stage along with restaurant owners, Gina Gruenwald of Wolf Peach, Karlos Soriano of C-viche, and Bennie and Angela Smith of Daddy’s Soul Food & Grille. They shared how transformative WWBIC and Baumann’s support had been to their business, and why that allowed them to “grab a seat at the table.”

“WWBIC, and those in our field, need to review our distribution channels and align our partnerships and collaboration better for these entrepreneurs and business owners, keeping the end users in mind,” said Baumann. “This is no longer an approach but a need, to have cohesive community plans. We know things do not just happen, we mold them into happening.”

WWBIC currently holds around 600 loans, totaling $16 million in their loan portfolio. In a recent SBA national ranking, WWBIC was placed as the 5th largest SBA micro-lender and community advantage lender in dollars, and 6th in the number of loans.

These images present highlights from the event, celebrating another year of WWBIC’s efforts to impact the lives in neighborhoods across the state.

© Photo

Lee Matz