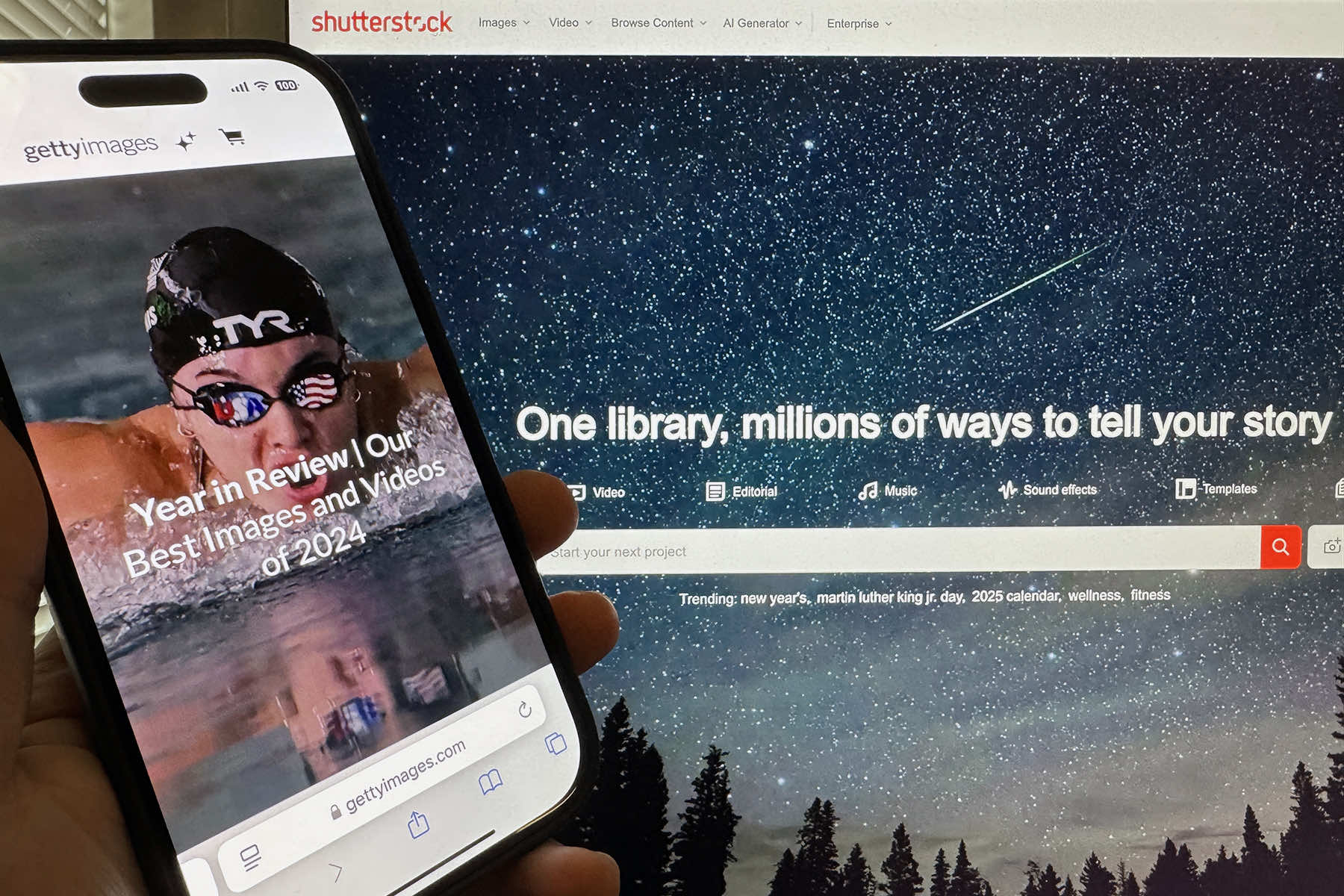

EDITOR’S NOTE: While the Milwaukee Independent has earned a respected reputation for its award-winning photojournalism over the past decade, practical necessities have still required the use of stock photography. As a disclosure, Milwaukee Independent is a subscriber to Shutterstock’s photo content and has licensed individual pictures from Getty Images over the years for event-specific editorial needs. Additionally, access to the photo library of the Associated Press is included as a member news service.

In a merger expected to reshape the stock photography and visual content market, Getty Images is joining with Shutterstock to create a $3.7 billion powerhouse, combining two of the most recognized names in the industry under the Getty Images banner.

The merger announcement on January 7 arrived at a pivotal time for stock photography and video providers, who are increasingly competing with artificial intelligence (AI) platforms capable of generating still images within seconds, shifting the landscape and forcing leading content companies to adapt or risk significant losses in revenue.

Beyond the traditional world of photographers and creative developers, stakeholders in many industries are watching to see how they will benefit from the merger. The integration of Getty Images and Shutterstock introduces new possibilities in product offerings, while also raising questions about licensing costs.

Although both companies celebrated the merger as an opportunity to pool their extensive libraries and fuel future innovations, many creators and customers took to social media to voice their concerns.

“I’m a photojournalist and the majority of my income comes from Getty and Shutterstock. I hope they don’t take the worst features from each company to incorporate in the merged new entity,” said one Reddit user.

The deal itself, which has been unanimously approved by both boards of directors, represents one of the largest consolidations in the visual media space in years. Mark Getty, the current Chairman of Getty Images, will serve as chairman of the board for the combined entity. In a joint statement, company representatives emphasized the strategic and financial benefits of merging.

“With the rapid rise in demand for compelling visual content across industries, there has never been a better time for our two businesses to come together,” said Craig Peters, CEO of Getty Images who will also serve as CEO of the merged company. “By combining our complementary strengths, we can better address customer opportunities while delivering exceptional value to our partners, contributors, and stockholders.”

Shutterstock shareholders will own approximately 45.3% of the newly formed company, while Getty Images shareholders will hold around 54.7%.

“We are excited by the opportunities we see to expand our creative content library and enhance our product offering to meet diverse customer needs,” said Paul Hennessy, CEO of Shutterstock. “We expect the merger to produce value for the customers and stockholders of both companies by capitalizing on attractive growth opportunities to drive combined revenues, accelerating product innovation, realizing significant cost synergies, and improving cash flow.”

Observers, however, remain divided over what it will mean for customers, photographers, and the market as a whole. While executives promote the merger’s long-term financial benefits, many of Shutterstock’s clients turned to the photo service in response to Getty Images’ history of tensions with its user base.

Getty Images is known for offering high-quality content at premium prices, whereas Shutterstock’s wide customer base includes budget-conscious designers, small media outlets, nonprofit organizations, and freelance content creators.

Representatives of Shutterstock have begun to offer reassurances to its subscribers, specifically telling the “Milwaukee Independent” that in the near term, nothing would change in how Shutterstock customers license images, videos, and other media. A company spokesperson also explained that there would be no immediate impact on how Shutterstock subscribers sourced, purchased, or managed content.

The merger is expected to offer customers more options to license content, as a benefit from the combined libraries. But despite belated efforts to reassure existing clients, the manner in which Getty Images and Shutterstock unveiled their deal has left some uneasy.

In many creative and editorial circles, the announcement sparked initial concern from businesses that rely on Shutterstock images. The fear is that the more expensive and stricter licensing by Getty Images would dictate massive changes.

Such apprehension was magnified by what critics say was an overly celebratory tone from the merging corporations by highlighting the revenue from their stocks, yet offering minimal public-facing information about the benefits to their customers.

“Both companies put all their energy into celebrating the new massive value and stock revenue windfall, while completely omitting any message or information to their extensive customer base,” said a consultant for a small nonprofit that relies heavily on stock photography via Reddit. “That only escalates the fear that policies and pricing structures could shift with little warning. It’s left people feeling anxious about how the transformation might jeopardize budgets or access to content.”

Many concerns appear to stem from the reputation of Getty Images across multiple industries. Getty Images has been criticized for what some consider heavy-handed approaches to enforcing copyright. Small businesses, nonprofits, and independent creators have reported receiving legal threats or invoices demanding substantial payments for the alleged unauthorized use of Getty-owned images. Often, these cases involved inadvertent use or unclear copyright attribution, leading to accusations that Getty prioritized revenue over fairness.

Photographers and content creators contributing to Getty have frequently voiced frustration about low royalties and restrictive contracts. Many feel that Getty takes an outsized share of earnings while offering limited transparency about how contributor payouts are calculated. The discontent has fueled debates about fair compensation for creators in the stock photography industry.

Getty has also been embroiled in controversies over how it licenses images. In one high-profile incident, Getty faced a lawsuit from photographer Carol Highsmith in 2016, who accused the company of attempting to charge her licensing fees for photos she took and later donated to the public domain. Although the lawsuit was dismissed, it amplified criticism of Getty’s practices and its role as a gatekeeper in the stock photo market.

Observers noted, regarding the lack of details for the public, that the approach aligned with standard merger protocol. Structural or policy alterations are typically revealed months, if not years, after a deal closes. However, the uncertain timeline encourages some corners of the creative world to brace for possible adjustments, especially in an environment increasingly shaped by artificial intelligence.

The merger also underscores a broader industry trend with the exponential rise of AI-generated imagery. The technology, capable of creating high-quality artwork, photos, and even short video loops, challenges traditional stock models. Enterprises that rely on ready-made images now have alternatives that may be more cost-effective or nimble than paying for licensed photos. By combining resources, Getty Images and Shutterstock aim to confront those emerging threats.

In their joint announcement, Getty Images and Shutterstock emphasized the strategic advantages of their merger. They stated, “The merger facilitates greater investment in innovative content creation, expanded event coverage, and customer-facing technologies and capabilities such as search, 3D imagery, and generative AI. It creates a broader set of visual content products across still imagery, video, music, 3D, and other asset types. Furthermore, it provides contributors substantially greater opportunities to reach customers around the world.”

The promise of a new global leader in visual content offers potential advantages for customers and photographers alike. It could translate to new revenue streams for content creators, deeper coverage of major events, and improved product development, particularly where advanced search and AI innovations could vastly refine the user experience.

At the same time, other critics question whether the combined company could reduce overall competition, especially for smaller organizations with limited budgets. Reports have indicated that many designers, nonprofits, and small publications prefer Shutterstock due to its simpler licensing approach and lower fees compared to the perceived premium environment at Getty Images.

In the short term, the merger of Getty Images and Shutterstock is generating excitement in the marketplace, evidenced by stock surges and an influx of news headlines. Both corporations have emphasized the financial benefits, particularly for an industry facing unprecedented challenges from free and paid AI image generators.

For many, the dream scenario involves an expansive, integrated library that meets the needs of varied types of clients. Yet for those who rely on Shutterstock’s relative affordability and streamlined structure, the apprehension is real.

As the deal moves toward completion, industry watchers acknowledge that significant changes usually take time. Ultimately, the merger’s success will hinge on whether the expanded content library, new technologies, and cost synergies genuinely boost value for consumers, rather than simply enriching shareholders.

In an industry increasingly buffeted by AI breakthroughs and evolving consumer needs, Getty Images and Shutterstock now have an opportunity to define the standard for licensing and content distribution, and to either solidify their bond with their user base or risk alienating a key segment of the creative economy.