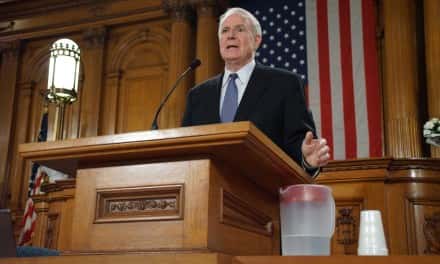

Wisconsin Governor Tony Evers announced the award of $24,760,812 in Federal Housing Tax Credits and $7,369,167 in State Housing Tax Credits to fund housing developments across Wisconsin on April 4.

The tax credits, which are distributed by the Wisconsin Housing and Economic Development Authority (WHEDA), will move forward 35 developments that will create 2,308 units of rental housing.

“WHEDA’s tax credit programs provide significant housing opportunities and help to boost the state’s economy,” said Governor Evers, as he announced the awards in Milwaukee at the Mercantile Lofts, a WHEDA-financed 36-unit multifamily development. “Developers, builders, and industry officials partner with WHEDA to construct much-needed quality, safe housing. Construction jobs created will give Wisconsin an economic shot in the arm.”

The combined Federal and State Housing Tax Credit award total is $32,129,979 that will help finance housing units in communities in Adams, Brown, Dane, Dodge , Green, Iowa, Jefferson, Kenosha, La Crosse, Marathon, Marinette, Milwaukee, Portage , Racine, Rock, Pierce, Oneida, Outagamie, Ozaukee, Sauk, Sawyer, Sheboygan, and Waukesha counties.

WHEDA has awarded $10,405,706 in total federal and state tax credits to eight Milwaukee-area developments: The 37th Street School Apartments ($775,687), Merrill Park ($899,840), Phillis Wheatley School Redevelopment ($1,252,564), River Parkway Apartments and Townhouses in Wauwatosa ($1,550,000), Thirteen31 Apartments ($1,173,094), Main Street Gardens & Cleveland Terrace ($472,000), Milwaukee Scattered Sites No. 2 ($717,064), and Westlawn Renaissance VI ($3,565,457).

“We are immensely proud of our mission,” said WHEDA Board Chair Ivan Gamboa. “We strive to stimulate the state’s economy and improve the quality of life for Wisconsin residents by providing housing financing products. Tax credits help us fulfill our mission by expanding housing opportunities throughout our great state.”

The federal tax credits are awarded over a ten-year-period and are worth over $247 million over their 10-year lifespan. The $7.3 million in state tax credits are worth over $43.8 million over a six-year lifespan. In exchange for receiving the tax credits, developers agree to reserve a portion of their housing units for low- and moderate-income households for at least 30 years.

Remaining units are rented at market rates to seniors and families without income limits. Tax credit developments must meet high design and operating standards. Criteria include strong management, excellent development quality, demonstrated market need, provision of services and amenities, proximity to economic opportunities, proper local zoning and permits and service to households at various income levels.

WHEDA has been the sole administrator for federal Housing Tax Credits in Wisconsin since the program began in 1986. WHEDA also administers the state program. Wisconsin Act 176 was signed into law in 2018 and created the State Housing Tax Credit program that is utilized in conjunction with the existing federal Housing Tax Credit program.

© Photo

Wisconsin Housing and Economic Development Authority (WHEDA)