Act 176 was signed into law on May 17, establishing a Wisconsin housing tax credit program that provides a tax incentive for private investment in the development or rehabilitation of affordable rental housing.

As the sole administrator for federal housing tax credits in the state, the Wisconsin Housing and Economic Development Authority (WHEDA) was chosen to lead the new program, including certification of eligibility and monitoring compliance. The Wisconsin Department of Revenue will issue the state credits on the tax returns of the recipients.

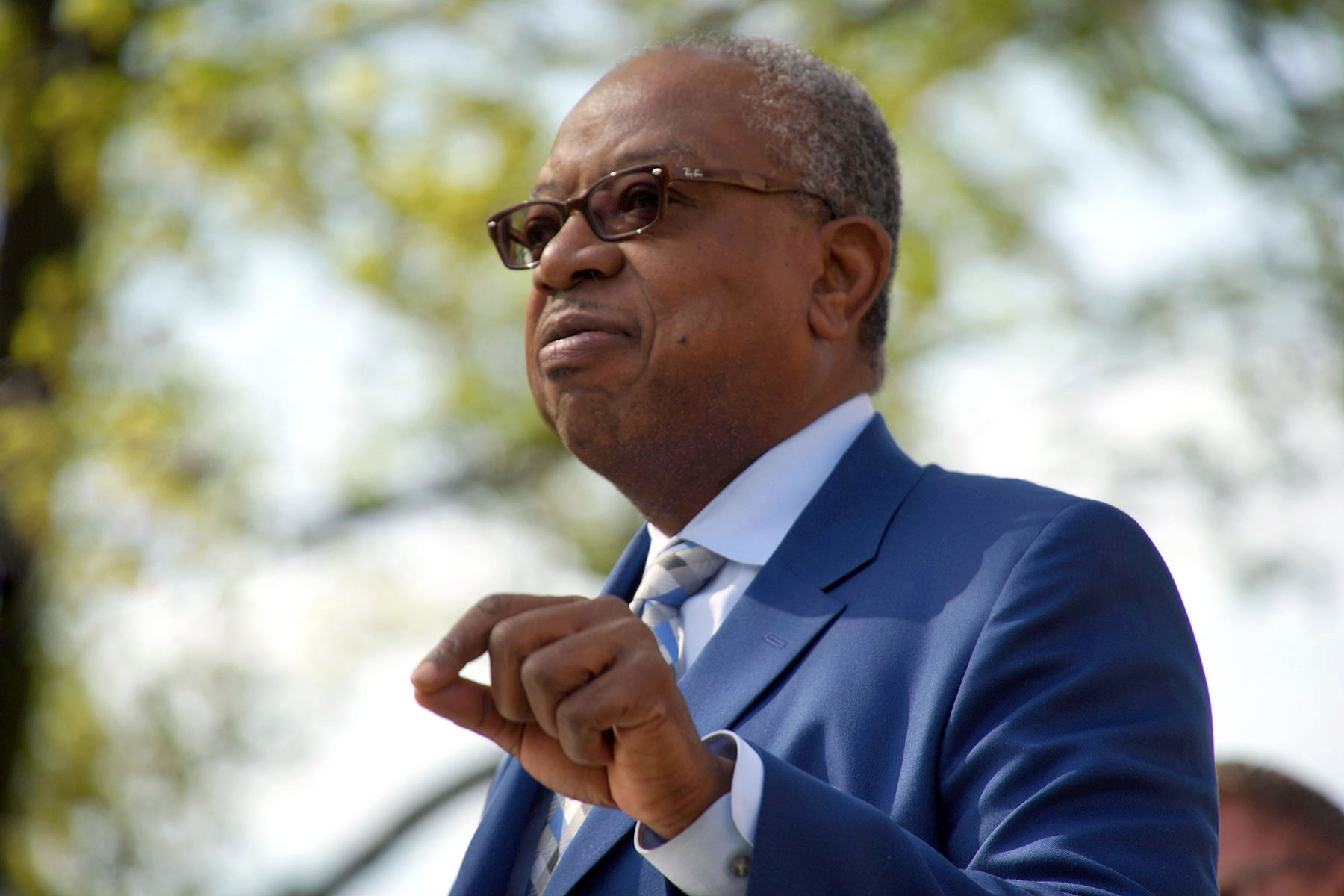

“This is tremendous news for the entire state,” said WHEDA Executive Director Wyman Winston. “The economic benefits are incredible, including the stimulation of quality rental housing, the creation of construction jobs, a reduction in cost burdens for renters, and an infusion of private capital throughout Wisconsin. The opportunities to find quality, safe, affordable housing across Wisconsin will be expanded substantially.”

WHEDA also administers the federal housing tax credits. The new state tax credit program can be matched with the federal 4% credit program increasing the leverage and creating the potential for a significant increase in affordable housing in Wisconsin.

ACT 176 gives preference to qualified developments located in municipalities with populations under 150,000. The allocation for the 2018 program is $7 million in tax credits for a period of six years. Each $7 million issued generates $42 million in credits over the six year period. There is no sunset to the program.

Since the federal housing tax credit program began in 1986, WHEDA has awarded more than $363 million in tax credits resulting in the development and rehabilitation of more than 54,000 units of affordable rental housing for low- to moderate-income families, seniors and persons with special needs.

For 45 years, WHEDA, as an independent state authority, has provided low-cost financing for housing and small business development in Wisconsin. Since 1972, WHEDA has financed more than 73,000 affordable rental units, helped more than 125,800 families purchase a home and made more than 29,000 small business and agricultural loan guarantees.

Kevin Fischer

Lee Matz