If Wisconsin legalizes medical or recreational marijuana, state regulations would drive whether small and minority-owned businesses thrive, or even survive.

The historic hub of black culture on the south side of Chicago called Bronzeville bears the marks of disinvestment, white flight and redlining common to many of the city’s black-majority neighborhoods. Along the expansive South Dr. Martin Luther King Jr. Drive, lines of greystones alternate in and out of disrepair, and many of the district’s blocks that were once home to vibrant institutions — earning it the name “Black Metropolis” — are now mottled with overgrown, vacant lots. A census tract within the area is one of the poorest in the city.

But for Seke Ballard and Seun Adedeji, the area is ripe for reinvestment because — not in spite — of it being disadvantaged. In late June, Illinois Governor J.B. Pritzker signed a law legalizing the recreational use of cannabis that lowers the barrier of entry to the industry for places like Bronzeville and its residents who have been disproportionately harmed by past cannabis laws and poverty. It takes effect January 1.

Though blacks nationwide use marijuana at similar rates to whites, they are much more likely to face criminal penalties for using it. In Wisconsin, blacks are four times as likely as whites to be arrested for pot possession, where all uses are illegal.

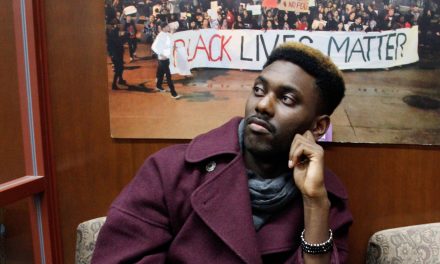

Sitting in the top floor of a renovated greystone apartment that just a few months prior was missing its roof, Ballard and Adedeji envision a Bronzeville, a Chicago and an Illinois revitalized by a cannabis industry operated by people reflecting the diversity of the state. It is a future in which cannabis storefronts and cultivators not only produce wealth for their owners and workers, but fuel an ecosystem of businesses surrounding cannabis, including contractors who build the storefronts, security camera installers and restaurants that feed them all.

“It’s a snowball effect, and this is a once-in-a-generation opportunity for people who come from communities that look exactly like this community that we’re in now to really use that spark to jumpstart economic development in those areas,” Ballard said. He is a Harvard-educated businessman and founder of Good Tree Capital, a firm that lends money to small cannabis businesses.

Though Illinois is the latest of nearly three dozen states to legalize recreational or medical cannabis, its market will operate in isolation from other states due to cannabis’ continued federal illegality.

To Ballard, Adedeji and many other entrepreneurs who have sought to chip off a piece of the quickly growing, multibillion dollar industry, this vacuum has brought into focus the power of state policy in determining the size, shape and diversity of the cannabis industry — and whether those who have been most harmed by past cannabis laws will be able to participate.

Cannabis legalization sparks boom

With 11 states and Washington, D.C., having legalized cannabis for adult recreational use and 33 states plus D.C. with medical cannabis laws, marijuana has quickly grown into an $8 billion industry that shows no signs of slowing down. Wisconsin is debating legalization — but Republicans who run the Legislature are not fully on board.

Democratic Governor Tony Evers has proposed legalizing medical marijuana and updating state laws on cannabidiol, or CBD, an over-the-counter treatment for anxiety, seizures and inflammation. Evers also wants to decriminalize possession of small amounts of marijuana. Nationwide, by 2022, legal cannabis revenue is projected to nearly triple from current levels into a $23 billion industry, according to the Arcview Group, a cannabis-focused market research firm.

If Wisconsin were to legalize cannabis for medical uses, there would be a net $1.1 billion positive effect, bringing in additional fees and health benefits while potentially reducing opioid overdoses, addiction and traffic fatalities over five years, according to a cost-benefit analysis by the University of Wisconsin-Madison’s La Follette School of Public Affairs. If the state were to decriminalize cannabis, it would save an additional $30 million in decreased criminal justice costs.

The study did not project potential state tax revenue, but the Legislature’s leading proponent of legalization, state Rep. Melissa Sargent, D-Madison, said such a move could bring in $138 million a year. The marijuana industry’s continued growth is almost unprecedented. Tom Adams, editor in chief of Arcview, said the only consumer industries to grow as largely and as quickly as cannabis in recent years are broadband internet in the 2000s and cable television in the 1990s.

The gatekeeper to the burgeoning industry is not a solid business plan or bank loan or even a seed of cannabis, however. Instead, owing to marijuana’s continued federal ban, the most critical element for entry is a state-awarded license.

State rules key to business size

When Florida voters approved Amendment 2 in 2016, legalizing the use of medical marijuana for those with debilitating conditions, the state implemented a merit-based application system, including whether a company had a medical director and its experience with cultivation.

Initially, companies could apply for one of five integrated licenses to be awarded for the entire state. Each “vertical” cannabis license — meaning the one license required for the company to own and operate the entire chain of production from cultivation to retail — allowed the winning company to open up to 25 dispensaries.

With the medical market projected to grow in Florida to $956 million by 2022, a scramble ensued for these five coveted licenses. Since then, the number of licensed operators has grown to 22, an expansion spurred in part by a lawsuit filed against the state.

Although states like Florida and New York have limited the number of licenses and required vertical integration, the merit-based application process effectively gave an advantage to large, well-funded corporations, said Andrew Livingston, an economic and policy analyst for the nation’s largest cannabis-focused law firm, Vicente Sederberg LLC, based in Denver.

“If it comes down to a competition between who has the best team and who has the most capital, the most well-heeled multi-state operators are going to win that race,” Livingston said.

Barriers for low-income entrepreneurs

Adedji owns a cannabis business in Oregon and is opening three retail stores in Massachusetts. His first foray into cannabis was as a middle schooler in Illinois when he consumed it as an escape from his home life and sold it illegally, he said. Adedji was arrested for possession in 7th grade.

It took Adedji three years to open the business in Oregon. He said the state required him to lease property before he could sell any products. By the time he received his license, Adedji could barely afford to stock the shelves.

Ballard considers Illinois’ legislation the “gold standard” in large part because it lowers the capital barrier that Adedji ran into. The law includes a cannabis business development fund of roughly $30 million to provide low-interest loans for those directly impacted by past cannabis laws. These “social equity” applicants include people who have been arrested or convicted of a cannabis-related offense, those whose families have, and people with strong ties to a community that has been disproportionately impacted by both poverty and cannabis law enforcement.

Adedji said his juvenile arrest qualifies him as a social equity applicant. Illinois’ medical cannabis program requires at least $400,000 in liquid assets and $50,000 in escrow for a dispensary. Just 20 licensed cultivation facilities produce medical cannabis for the entire state, according to Illinois Policy, a nonprofit advocacy organization that promotes personal freedom and prosperity.

“So when you think about who the hell has that kind of money, you get a pretty clear idea of who can clear those barriers,” Ballard said. “But in the recreational legislation, they’ve done away with all of that.”

Under recreational legalization, the cost of entry is much lower — Ballard said as low as $5,000 with a social equity discount. With the state’s development fund, Ballard hopes that the reduced cost will combine to lower the barrier of entry.

”People will have an easier time getting into the industry and the owners (will) reflect the diversity of the state rather than deep pocketed people who can afford really expensive licenses.”

Wisconsin bill eyes small companies

In Wisconsin, Sargent has introduced legalization bills in the past three legislative sessions, and an important element includes encouraging small producers. She and Evers both want to see a cannabis industry that matches the values of the state and does not allow monied players to dominate it, she said.

In Sargent’s latest bill, cannabis business licenses would be split into five categories – producer, processor, distributor, retailer and microbusiness – but, as in most states, a business could hold multiple licenses. The bill does not include provisions for social equity applicants or disproportionately impacted areas.

A merit-based application process would rank applicants across several dimensions, including environmental protection and ability to provide stable, family-supporting jobs to local residents. Any businesses with 20 or more employees would also be required to enter a “labor peace agreement,” which would prohibit employees from strikes and picketing and the applicant from disrupting any labor organizing efforts.

Wisconsin has the opportunity to provide a “boutique crop,” Sargent said, with farmers across the state producing a wide variety of high-end cannabis products. Since 2018, the state’s farmers have shown considerable interest in growing cannabis. During the state’s most recent hemp pilot program, nearly 2,100 applications were submitted to grow and process hemp, a non-intoxicating material derived from the cannabis plant, according to the state Department of Agriculture, Trade and Consumer Protection.

“People are very entrepreneurial with this crop. There are things that have been talked about that I would not have anticipated, including micro greens or using hemp as botanicals,” said Jennifer Heaton-Amrhein, who helped formulate Wisconsin’s pilot program for DATCP. “When you have a wide open program, that is one of the things that happens, is people experiment and they’re entrepreneurial. Many of our hemp growers are learning how to grow hemp because it’s exactly the same plant (as cannabis) and they’re waiting for legalization.”

Limits on licenses favor big business

In Florida, not only did limiting licenses squeeze out smaller businesses from participating in the market, but requiring licensees to build out a cannabis grow, manufacturing facility and storefront required a massive capital investment in the first place, Livingston said.

It also boosted even higher the valuations of the companies that won the licenses. One license eventually sold for $48 million to the private equity firm iAnthus Capital Holdings, a well-funded cannabis player. That is before GrowHealthy Holdings had seen a “dime in revenue,” said Kris Krane, co-founder of 4Front, a multi-state cannabis consultant and operator headquartered in Phoenix.

Consumers, too, are impacted by limited licensing. Limited-license, vertically integrated producers typically produce fewer varieties than producers in more competitive markets, according to Vicente Sederberg LLC’s Andrew Livingston. Krane said the best product and the best prices come from companies in competitive markets out West.

“If you’re one of only a handful of players in your market, and particularly if it’s a vertically-integrated market, you don’t have to be a great producer,” Krane said. “You just have to be good enough, and you’re going to get lots of market share.”

Oregon opens doors wide to pot

Too many licenses can create its own problems. When voters in Oregon voted to legalize adult-use cannabis in 2014, the state took the opposite route. It liberally awarded licenses, requiring a maximum fee of $6,000. By comparison, New York requires more than $200,000 in licensing fees.

Since cannabis was legalized, so many people have entered the industry that there is a licensed cultivation operation for every 19 cannabis users, according to the Oregon-Idaho High Intensity Drug Trafficking Area, a coalition of local, state and federal agencies. The overproduction of cannabis triggered a drop in wholesale prices and created an oversupply. That bled into 37 other states through black markets, the drug task force said. Krane favors national legalization.

“I think if you open this up to a federal system, with full interstate commerce, it’s a bit of a different story,” Krane adds. “A lot of these businesses in Oregon and Washington, who are really some of the best producers in the country, in a true national market I think some of their products would be highly sought after by other parts of the country.”

Individual investors drive growth

At the federal level, banking and tax laws also make it hard for smaller businesses to exist in the cannabis market. Due to cannabis’ federal illegality, traditional sources of funding for businesses such as bank loans are generally not available, Krane wrote in his cannabis-focused column for Forbes. Although the number of banks that are willing to interact with the cannabis industry is increasing, according to the U.S. Treasury Department, there is still a barrier between entrepreneurs and banking.

Without these funds, small businesses are largely funded by the entrepreneur’s friends and family, Livingston said, which provides an advantage to whites, who benefit from a massive racial wealth gap. According to the Census Bureau’s Current Population Survey, for every $100 in white family wealth, black families have $5.04.

Less than a fifth of marijuana business owners identify as racial minorities, and 4.3% are black, according to a report from Marijuana Business Daily, referring to a group that has experienced long-standing and severe racial disparities in cannabis law enforcement. Seventeen percent of executives in the industry are racial minorities, however — a larger proportion than U.S. businesses as a whole.

Cannabis entrepreneur Abbie Testaberg fears big businesses will come to dominate the state market if Wisconsin legalizes marijuana for medical and recreational uses. Testaberg and her husband, Jody, run three cannabis companies: a hemp growing operation in Wisconsin; PhytoPharm.D, a cannabis consulting and education company; and Whole Plant Technologies, which sells a tray system for growing cannabis.

Under Sargent’s bill, small businesses could get a discount on licenses. A “microbusiness” license would be offered to small growers that plan to do two of the remaining three licensed activities: process, distribute or sell cannabis.

Wisconsin’s dairy industry gives Testaberg more fear than hope with how the state would go about drafting its regulations, however. Just as large farms have advantages that smaller farms do not, large cannabis companies could become the norm, she said.

“If we enter the cannabis industry regulation the same way as where we’re currently at with big farm regulations, we’re going to create the same monster, and then we’re going to create it much quicker because those same players are going to jump in and they’re going to know how to manipulate the system,” Testaberg said.

Parker Schorr

Parker Schorr and Emily Hamer

The nonprofit Wisconsin Center for Investigative Journalism collaborates with Wisconsin Public Radio, Wisconsin Public Television, other news media and the UW-Madison School of Journalism and Mass Communication. All works created, published, posted or disseminated by the Center do not necessarily reflect the views or opinions of UW-Madison or any of its affiliates.